Next agrees take-private for Australian accommodation manager

Next Capital has agreed to acquire Australia-based holiday accommodation manager Alloggio Group for a valuation of AUD 48.2m (USD 32.7m) after cutting the offer price by 20%.

The mid-market private equity firm will buy all outstanding shares for AUD 0.24 apiece through a scheme of implementation, according to a filing. This represents a 50% premium to the June 9 closing price….

Local HNWs, instos in Next Capital’s Fund V, final close at $375m

Mid-market private equity firm Next Capital has locked in $375 million for its latest fund, which saw domestic investors account for more than half of commitments and a final close ruled off last week.

Sources said the fund-raising – led by founding partners John White and Patrick Elliott, who together with Sandy Lockhart spun Next out from Macquarie Bank in 2005 – punched through the initial $350 million target and attracted half a dozen new investors.

It is understood ASX-listed Alloggio Group, a short-term rental operator which Next is seeking to acquire via a scheme of arrangement and has just commenced the court process for, will be the new fund’s second investment. (Next did a rapid-fire first close earlier in the year to fund a majority stake in rehabilitation retailer Country Care.)

When contacted by Street Talk on Monday, White declined to comment on details of the fund. “It’s good to see local institutions and high-net worth investors returning to Australian lower middle-market funds,” he said.

Importantly, Next Capital’s existing investors, which include Michael Lukin’s Roc Partners, industry super giant CBUS and MLC Wealth, have been attracted to Fund V because they are familiar with, and keen to invest with, the same deal makers that have had success with earlier funds. Next’s last fund made more than 30 per cent returns on an IRR basis.

The Sydney-based buyout firm earlier this year elevated investment director Bing Jiang to partner status, rounding out the partner roster to five. Jiang helped oversee investments in baggage handler Aerocare, health supplements business Vitaco, and mini golfing company Funlab.

In 2014, James Murphy was promoted to partner, while Next also counts David Browne among its investments team. Co-founder Sandy Lockhart has since retired. However, he remains on the investment committee.

Limited partner sources pointed to director Adam Dicembre as a deal maker to watch. Dicembre most recently drove the buyout shop’s investment in budget campervan and car hire group Jucy Rentals, alongside Elliott.

Jucy Rentals found a home in Next Capital’s fund IV, which also owned stakes in equipment rental business Silverchef, contractor Eptech Group and remediation company Enviropacific Services. Recent divestments include urban bus line business NZ Bus, which was sold to Australia’s largest bus network Kinetic in early 2022, and the sale of bowling alleys and mini golf company Funlab to TPG in 2020.

Article Access: Local HNWs, instos in Next Capital’s Fund V, final close at $375m (afr.com)

Private equity to help keep campervan rental prices down

The competition regulator says the deeper pockets of private equity group Next Capital which is now a major backer of campervan rentals group Jucy should help inject competition into the sector, as it gave the green light to a merger of the two largest rivals in Australia, Apollo and Tourism Holdings.

The Australian Competition and Consumer Commission forced the divestment of $39 million of assets to smaller competitor Jucy. It said on Thursday that was enough to clear the broader union between Apollo, which is listed on the ASX, and Tourism Holdings, which is listed on the New Zealand stock exchange. The proposed deal was first announced last December.

Tourism Holdings operates brands in Australia including Maui, Britz and Mighty Camper. Apollo operates rental brands including Star RV, Apollo, Cheapa Campa and Hippie Camper.

Apollo shares climbed 11 per cent in early trading on the ASX on Thursday to 72¢. The stock was at 38¢ on June 30.

The ACCC in April had serious issues with the combined market power of Apollo and Tourism Holdings, and so a lengthy process of carving off some assets to appease them began months ago.

ACCC deputy chairman Mick Keogh said on Thursday that the divestment to Jucy would enable it to build sufficient scale to ensure more competition in the industry.

“Tourism Holdings and Apollo are the two largest suppliers of rental RVs in Australia and are each other’s closest competitor in a market where smaller rivals and potential entrants appear to face challenges achieving comparable scale,” Mr Keogh said.

He also outlined that Jucy now had private equity group Next Capital as a major backer after a deal which had just been signed, and that should also ensure it had the financial firepower to make sure it is a strong competitor.

Full Article Access: Private equity to help keep campervan rental prices down (afr.com)

Next Capital ready to drive away with Jucy Rentals

It’s down to the short strokes in buyout shop Next Capital’s quest for a piece of Australia and New Zealand’s tourism markets.

The firm’s understood to be finalising documentation and funding for its $30 million investment in campervan and car hire group Jucy Rentals, which would be a big enough cheque for it to gain a controlling stake.

Next Capital has MinterEllison’s lawyers and PwC’s number crunchers helping stitch the deal together.

Next Capital’s $30 million investment in Jucy Rentals is a precursor to another deal – the purchase of motorhomes and forward bookings from listed Tourism Holdings, which is seeking to offload assets to get its own M&A deal past competition regulators in Australia and New Zealand.

Should it all come together, Next Capital would emerge as a big player in motorhomes and rentals on both sides of the Tasman, via the budget-focused Jucy Rentals brand and more upmarket Star RV label.

Article Access: Next Capital ready to drive away with Jucy Rentals (afr.com)

Next Capital buys into rehabilitation retailer Country Care Group

Mid-market private equity firm Next Capital has snapped up a majority stake in Country Care Group, a supplier and retailer to the assisted living and aged care sectors, in a deal valuing the company at about $150 million.

The firm has partnered with CCG founder Rob Hogan, and his son and new chief executive Tom Hogan, taking a 51 per cent stake, and making Next the first outside investor.

A year ago CCG, Rob Hogan and a former employee were acquitted of criminal cartel offences bought by the Commonwealth after a competition regulator’s investigation relating to alleged price-fixing.

CEO Tom Hogan told The Australian Financial Review the case was disruptive to the business since the family had to shovel a lot of money into the case. But there was now a silver lining in finding a new partner, Next.

“[The case] restricted our cash flow to invest into the business as far as acquiring new stores and also expanding from greenfield sites because most of our cash went into the ACCC process,” he said.

“We’re happy with where the business is at today. It’s a very successful business. The Next team are excited to be a part of it and help us get to that next level.”

The family-run business, founded in 1997, has a strong regional focus. It is a key supplier to government agencies such as the Department of Veterans’ Affairs, and distributor of products ranging from mobility aids, specialist chairs and seats to lifters and slings. It also works alongside occupational therapists and architects for home modifications services.

With fresh equity and debt funding, Tom Hogan said the plan was to reach 75 stores from its 18 sites over the next three to five years. That will come from a mixture of buying stand-alone retailers, subcontractor supplier stores, and it will also look for new greenfield store sites.

Next Capital deal makers James Murphy and David Browne led the transaction. Mr Murphy said Next aimed to capitalise on the key thematic of a growing ageing population.

Full Article Access: Next Capital buys into rehabilitation retailer Country Care Group (afr.com)

Next Capital gets Compare Club in $100m-plus deal, E&P on ticket

Mid-market buyout firm Next Capital has gone shopping for insurance against cost of living pressures and returned home with online comparison business Compare Club.

Street Talk can reveal Next Capital has paid upwards of $100 million for the insurance and utilities comparison service, and installed founding partner Patrick Elliott and young gun Adam Dicembre on the company’s board.

Next Capital’s investment looks like a play on the rising costs of living in Australia, putting pressure on households.

It is understood the transaction completed at the end of last week, wrapping up months of talks between the two parties. Next Capital was advised by E&P and Corrs Chambers Westgarth, while Stanton Road Partners was in Compare Club’s corner.

The investment looks like a play on the rising costs of living in Australia, putting pressure on households and causing them to think about saving money on major bills.

Compare Club offers quotes on health and life insurance policies, electricity and gas connections and home and car loans, often within minutes.

The group had its eyes on an initial public offering late last year, however switched paths and has ended up in a sale to Next Capital. Street Talk revealed the talks last month.

Next Capital founder Patrick Elliott (pictured) and dealmaker Adam Dicembre led the investment.

The comparison website business told listed equities investors it would make about $20 million EBITDA in the 2022 financial year, as part of its IPO preparations.

It’s expected to find a home in Next Capital’s fund IV, which has last week received regulatory approval to pick up budget car and campervan rental group Jucy, and also owns stakes in equipment rental business Silverchef, contractor Eptech Group and remediation company Enviropacific Services.

Full article acess: https://www.afr.com/street-talk/next-capital-gets-compare-club-in-100m-plus-deal-e-and-p-on-ticket-20221002-p5bmiq

New partner at mid-market PE firm Next Capital

Next Capital sells NZ Bus

Australia’s largest bus network Kinetic is in exclusive negotiations to acquire Next Capital’s urban bus line business NZ Bus, in a deal that would entrench its position as the largest Australasian operator.

The 30-year-old NZ Bus is one of New Zealand’s biggest bus operators with more than 700 buses across its 13 depots. The company services Auckland, Wellington and Tauranga, mostly operating on behalf of local governments.

The sale price is understood to be just north of $NZ400 million.

Next Capital bought NZ Bus from dual-listed Infratil in 2019. AFR

Kinetic, which started out more than 40 years ago with a single bus in Melbourne, operates the SkyBus between Melbourne’s Southern Cross Station and Tullamarine Airport and is already the biggest mass transit operator in Australia and New Zealand. It has 53 bus contracts from 56 depots from Cairns to Hobart and Auckland to Dunedin.

Kinetic is backed by OPTrust, one of Canada’s largest pension funds with net assets of over $23 billion, and Australian investment firm Infrastructure Capital Group.

First-round bids were only due last week for NZ Bus, but an unusually quick process meant final bids were submitted on Monday. Investment bank UBS began road testing appetite for the company in December.

Australia’s largest integrated land and marine, tourism and public transport service provider, ASX-listed Kelsian Group – formerly known as SeaLink Travel Group – was an underbidder, sources said.

Private equity firm Pacific Equity Partners also sniffed around in the early stages, while KKR — which owns Kiwi bus company Ritchies Transport — opted not to bid.

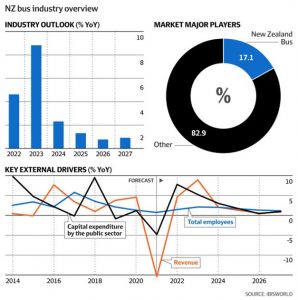

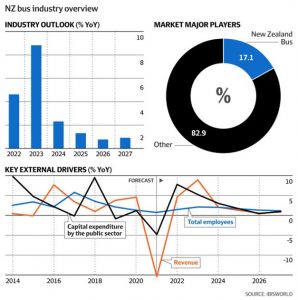

In New Zealand, COVID-19 lockdowns beat down bus industry revenues, which fell about 15.3 per cent in the 2021 financial year, according to IBISWorld. Improved conditions are expected in the next five years.

Wheel-y big returns for Next investors

Kinetic acquired New Zealand bus company GoBus in 2020 from Maori funds Ngāi Tahu and Tainui Group, which bought the business from Next Capital six years earlier. Buses account for 75 per cent of public transport trips in New Zealand.

If the transaction completes, it will be Next Capital’s third exit in the past 12-months, during which the John White-led buyout firm has returned more than four times money to its investor base.

Next Capital only acquired NZ Bus in September 2019, taking it off dual-listed infrastructure investor Infratil for around $NZ130 million after post-completion adjustments.

The deal ended a 14-year ride on public transport for Infratil.

KKR & Co last year paid about $NZ500 million to acquire Ritchies Transport. That deal was overseen by Rothschild.

Article access: https://www.afr.com/street-talk/kinetic-among-bidders-for-next-capital-s-nz-bus-20220309-p5a35o

Australasia’s biggest ever electric bus order!

Australasia’s biggest electric bus order has been announced, in a partnership between Auckland Transport and NZ Bus.

This will see a further 152 battery electric buses (BEVs) on Auckland’s roads and will reduce greenhouse gas emissions from the AT Metro bus fleet by an estimated 11 per cent per year– which is almost 10,000 tonnes of carbon dioxide annually.*

These BEVs will replace around 12 per cent of the diesel bus fleet in Tāmaki Makaurau, in alignment with AT’s Low Emission Bus Roadmap 2020 (LEBR).

The additional BEVs will significantly boost the number of zero emission buses operating on AT bus services across Auckland with NZ Bus providing services in the city centre and across some of the city’s most congested urban areas.

Mayor Phil Goff says the new electric buses will help Auckland progress its climate change goals by reducing carbon emissions from transport.

“These 152 new e-buses will replace around 12 per cent of Auckland’s diesel bus fleet and reduce Auckland Transport’s greenhouse gas emissions by an estimated 11 per cent annually – equivalent to almost 10,000 tonnes of carbon dioxide a year,” he says.

“With transport making up more than 40 per cent of Auckland’s emissions profile, it’s crucial that we pull every available lever to reduce emissions.

“Having already halted the purchase of new diesel vehicles and rolled out 33 electric buses on more than 13 services throughout the region, this is another step towards a zero-emissions bus fleet for Tāmaki Makaurau. It’s encouraging to see Auckland Transport and NZ Bus working together to make that happen.”

The BEVs will be deployed across four years, with plans for the first group to be driving the Tāmaki Link from October next year, followed by other services operated from the central and east Auckland bus depots.

AT’s Chief Executive, Shane Ellison, says it is critical that carbon emissions are reduced across the globe.

“As an organisation, Auckland Transport is dedicated to doing our bit by actively supporting the goals of Te Tāruke-ā-Tāwhiri: Auckland’s Climate Plan.

“We are well on our way in transitioning to an emissions-free public transport fleet by 2040, which will have a myriad of benefits for Tāmaki Makaurau – including improved air quality within the city centre and healthier communities.

“Within the last 18 months we’ve introduced 33 new electric services in the city, Waiheke Island, as well as the new AirportLink service connecting with electric trains at Puhinui Station for a carbon-free trip to Auckland Airport. The announcement of 152 additional electric buses is extremely positive for our city.”

AT and NZ Bus and have been working on plans to accelerate the BEV introduction since late 2020 following a proposal from NZ Bus to replace a significant part of its current diesel fleet with electric buses.

NZ Bus Executive Director of Strategic Projects, Peter McKenzie says:

“Auckland Transport and Auckland Council have been very supportive of the proposal and keen to work with us to increase the number of electric vehicles operating on AT’s bus services.

“The new decarbonisation team at Auckland Transport has been great to work with and really keen to improve Auckland’s emission profile as soon as possible. With support from AT and Waka Kotahi NZTA, we will significantly accelerate the electric vehicle rollout over the next four years and create a platform for further decarbonisation strategies to follow from there.”

AT’s current zero-emission bus fleet is being showcased in a virtual exhibition at the United Nations Climate Change Conference (COP 26) in Glasgow this month.

To view AT’s case study in the virtual room at COP 26, please click here

*relative to 2019 emissions.

Article access: https://at.govt.nz/about-us/news-events/australasia-s-biggest-ever-electric-bus-order-will-remove-10-000-tonnes-of-emissions-annually/

Amber Infrastructure buys majority stake in iseek Communications

British-based infrastructure asset manager Amber Infrastructure has made its first foray into digital assets in Australia, buying a majority stake in Brisbane-based data centre operator iseek Communications.

While the terms of the deal were undisclosed, it is expected to be worth upwards of $110 million.

Amber Infrastructure Group APAC head Vaughan Wallace has led the acquisition of Brisbane company iseek Communications.

The purchase is an unusual one for Amber, which historically has stuck to social infrastructure assets such as public hospitals and transport, but is a sign of things to come for the local branch of the multinational asset manager.

Speaking to The Australian Financial Review, Amber’s head of Asia-Pacific, Vaughan Wallace, said the fund was planning to buy up more mid-market digital infrastructure assets.

“There has been a deliberate push to broaden the business,” he said.

“There’s very few opportunities in the digital space unless you want to get involved in Singtel-style tower shootouts. Our focus … will be in the mid-market space.

“There’s a lot of money chasing the larger transactions. But that’s not our best opportunity to get involved. Our best opportunities are smaller to mid-sized stuff, with private equity looking to move out [of an asset] a good opportunity for infrastructure investors like us to step in. And that’s what happened on this transaction.”

Amber has $7 billion worth of social infrastructure assets under management in Australia and employs 18 people locally.

Growth opportunities

Amber already owns or has significant stakes in public social infrastructure assets such as Melbourne’s Royal Children’s Hospital, the Gold Coast Light Rail, Orange Hospital and New Schools Victoria.

Iseek Communications operates five data centres across Brisbane, Townsville and Sydney, focusing on the government and enterprise market, rather than hyperscale clients such as the tech giants.

The company is a fraction of the size of larger players like NEXTDC or AirTrunk, with a total of 11 megawatts of capacity, but is competitive with these businesses in Brisbane.

Mr Wallace said buying into a business while it was smaller gave it a chance to have more upside.

“We’re prepared to be flexible and look at something small if it’s a good opportunity,” he said.

“We see this as a chance to come in and grow the iseek business. The business in its own right is performing well but there’s a lot of growth opportunities in there and we think we can work with the existing management team to help them fund and grow the business.

“We’ve had a number of conversations with Jason Gomersall [the founder and CEO] about opportunities arising. Some are in other cities and there’s also potential for more regional facilities, but we’re open at the moment … the key focus is on leasing the facilities they have and then looking at next big opportunity.”

Across Europe and Britain, Amber already has digital infrastructure investments such as Greenergy (a data centre platform in central and eastern Europe) and the British government’s National Digital Infrastructure Fund.

Mr Wallace joined Amber from Capella Capital 12 months ago, with the purpose of diversifying its investments beyond its core social infrastructure niche. He hopes to grow the local team beyond its 18 employees as it does more digital deals.

“This is a critical step in doing our first transaction outside of critical infrastructure, but we’re looking to add to the team over time.”

Article access: https://www.afr.com/technology/amber-infrastructure-buys-majority-stake-in-iseek-communications-20210617-p581t1

Auckland woman hits new mark in male-dominated trade

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/TSPIPUSZBFLNJLIDB27FCY7EHY.jpg)

Antionette Campbell. Photo / Supplied.

“Petrified” at first, Auckland woman hits new mark in male-dominated trade.

The wheels turned faster than expected for Antionette Campbell, a woman whose career in a male-dominated sphere accelerated beyond expectations.

After three years as a bus driver at NZ Bus – New Zealand’s biggest operator of urban bus services – Campbell was offered the opportunity to train to become an instructor, and she jumped at the chance.

“When I was a trainee bus operator, I told my husband – who’s also a bus driver – that one day I’d like to be an instructor at the training school. I pretty much put it down as a five-year plan,” says Campbell, based out of NZ Bus’s North Shore depot in Auckland.

The five-year plan was completed way ahead of schedule for Campbell, who not only became a certified instructor in 2020 but is now also a driving assessor – the first woman to hold the position in NZ Bus’s 25 years of operation and an example (published on International Women’s Day) of what women can achieve.

Initially, the move to NZ Bus was a sideways step in Campbell’s career. Having previously worked as an assistant property manager, she was ready to try something new.

“It’s surprising how many of my skills from that role have been transferable to my work at NZ Bus,” says Campbell, adding that good people skills have been vital to her success.

The opportunity for growth was also a major factor in her initial decision to join the company: “Promotions are a real possibility for anyone working at NZ Bus – that’s something that was always made clear to me from the outset.”

Toni Daynes, regional manager at NZ Bus’s Tauranga depot, agrees. Having first entered the bus industry as an operations supervisor 13 years ago – at just 17 years old – Daynes found herself quickly climbing the ranks in her career too.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/KWEAYNP72XUGJOW3EIMCYOYB7E.jpg)

L-R: Yvonne Meachen (Bus and Tutor Operator), Jenni-lee McNamara (School Bus Operator and Health & Safety Committee Representative), Toni Daynes (Regional Manager (Bay of Plenty) and Chair of the Health & Safety Committee), Antoinette Manuel Jose (Bus and Tutor Operator). Photo / Supplied.

Last year she joined NZ Bus as a service delivery manager and, in less than two months, was promoted to regional manager. Now she’s responsible for three NZ Bus depots across the Bay of Plenty with almost 250 staff, including everyone from drivers to management. She’s also in the final stages of an Executive MBA, a decision supported by NZ Bus.

“I think one of the best parts of my role is to be able to offer opportunities for career progression. I really get a kick out of helping people achieve their goals,” says Daynes, adding that NZ Bus is currently looking for new recruits.

The best thing anyone can do in a job interview for NZ Bus, she says, is to communicate their aspirations early on: “If you’re interviewing for a driver position, don’t be shy in telling us what your career ambitions are. I always latch onto that in interviews – I want to know our drivers’ dreams so we can help them reach their goals.”

Daynes points to the example of two female drivers who joined her team less than a year ago, and who now hold the top spots on their driving technique leaderboard.

“These women have a real passion for bus driving and for interacting with their passengers. We’ve now begun the process of putting them through their driving instructor tickets which is a really exciting development in their careers.”

Campbell says the best part of her new role as a trainer is seeing new team members move through the school: “A lot of people start out very unsure of themselves but in a matter of months or even weeks we start to see them become such confident drivers.

“I was the same: I was petrified on my first day behind the wheel, but it only took a few weeks until I was totally comfortable.

However bus driving still isn’t a profession known for its high uptake of women. The 2018 Census reported that only 21 per cent of bus drivers nationwide are women – but Daynes says numbers are on the rise.

“At NZ Bus we have around 1300 bus drivers across the Bay of Plenty, Auckland and Wellington. Approximately 16 per cent of my drivers in Tauranga are women, which may not sound like a lot, but it is a significant increase from when I first started in the industry,” says Daynes, adding that 40 per cent of her front-line management team are women, which is especially high for the industry.

“I enjoy working closely with the Bay of Plenty Regional Council’s transport operations team daily, most of whom are female also. I am chairwoman of our health & safety committee and I’m proud to say our most recently elected committee member is a female school bus driver who does an important job of representing her entire depot on Health and safety.

“No one day is the same in my operational role – a “normal” day for me includes staff performance management, data analysis or liaising with the council to optimise our overall service delivery for the public.

“So I’d like to encourage women from all walks of life to consider bus driving as a genuine career path with multiple opportunities, whether that’s fleet engineering, driver training or management.”

Barry Hinkley, NZ Bus CEO, says: “I am Looking forward to welcoming more females to the workforce as there are plenty of opportunities for career growth at NZ Bus.”

Article access: https://www.nzherald.co.nz/sponsored-stories/careers-moving-faster-for-women-bus-drivers/D64CAD2TBQWGXB7IJNRFB3LYHQ/

TPG Capital set to Strike at Funlab

Global private equity firm TPG Capital is set to acquire Australian bowling alleys and mini golf company Funlab.

It is understood TPG’s Australian team agreed the $250 million-odd purchase on Monday night, which will see them take Funlab off the hands of domestic PE outfit Next Capital.

Citi was sell-side adviser on the deal, while MinterEllison provided legal advice. Quentin Miller’s Intrinsic Partners and Herbert Smith Freehills tended to TPG.

As part of the deal with TPG, Funlab boss Michael Schreiber and his management team – who were advised on their options by Arnold Bloch Leibler – will roll a portion of their 25 per cent stake into the BidCo.

TPG is expected to partner with Schreiber to grow the leisure business, which was heavily disrupted by the COVID-19 pandemic and associated lockdowns. Funlab operates leisure venues ranging from Strike bowling alleys and Holey Moley indoor golf venues to Sky Zone trampoline centres, B. Lucky & Sons game arcades and Juke’s karaoke bars.

Joel Thickins-run TPG’s thesis is about capitalising on the long-term shift in consumer spending towards experiences and away from products, which has shopping malls and other landlords trying to anchor properties with large leisure and entertainment offerings.

TPG reckons it can expand Funlab’s sites in Australia and offshore, develop new concepts and better use data and analytics to tailor products to customers.

For Next Capital, the deal comes one year after it had an agreement to sell the business to fellow Australia PE firm Archer Capital.

However, that agreement fell over when COVID-19 first hit Australia’s east coast in March, and cities were locked down to control the outbreak. Next Capital also considered floating the business last year.

Sources told this column there was just four weeks between TPG starting due diligence to signing, and that the deal was struck with bilateral, confidential engagement with Next and Funlab’s founders.

It caps a busy 12 months for TPG which exited its investment in poultry producer Inghams; recapitalised clinical research business Novotech with a new $200 million funding package, without the help of external advisers; and had its pets and vets company Greencross firing through the pandemic.

Funlab is expected to sit in TPG’s Asia buyout fund.

Article access: https://www.afr.com/street-talk/tpg-capital-set-to-strike-at-funlab-sources-20201216-p56nww

The Silverfern Group in Partnership with Next Capital

Aug 19, 2020

The Silverfern Group, an investment management firm making direct investments in middle market private equity globally, today announced that it has partnered with Next Capital in the acquisition of Eptec.

Eptec, founded in 1997, is an Australian-based specialist engineering contractor focused on asset preservation and maintenance services to the marine sector (defense and commercial) and other critical transport and infrastructure assets.

The Silverfern Group

“We are excited to partner with Next Capital in the acquisition of Eptec, a leading specialist engineering contractor in the Australian market,” said Silverfern Managing Partner Clive Holmes. “Silverfern Advisory Board member Geoff Knox, an experienced senior Eptec executive, has helped us evaluate the Eptec investment opportunity and has stepped up to the role of CEO upon completion of the acquisition. The acquisition of Eptec further demonstrates Silverfern’s ability to source, access and execute on attractive stable local investments, even during challenging economic times such as the COVID-19 pandemic, as we continue to invest on a global basis.”

About Eptec

Founded in 1997 Eptec has a 22-year track record providing asset preservation and maintenance services to government and prime corporate clients. Eptec delivers time-critical, highly-technical, specialized asset life extension of complex operational assets through a range of solutions for Corrosion Protection, Concrete Rehabilitation, Fibre Reinforced Plastics, Waterproofing and Linings, and Insulation, and operates through two business segments: Marine and Services. The Marine business segment services defense and commercial sectors and the Services business segment services transportation infrastructure (including bridges, rail and ports), energy and resources, waste and wastewater, and buildings and facilities.

Full article access: https://www.prnewswire.com/news-releases/the-silverfern-group-invests-in-eptec-in-partnership-with-next-capital-301114600.html

Next please! Buyout fund scoops up Alceon's Eptec

Feb 9, 2020

Mid-market private equity firm Next Capital has teamed up with a United States-based investment manager to take control of an Australian specialist engineering contractor.

Street Talk can reveal Next Capital and The Silverfern Group have agreed a deal to acquire Eptec, which is majority owned by ex-Babcock & Brown bankers Phil Green and Trevor Lowensohn’s investment firm Alceon.

It is understood Next and Silverfern made an unsolicited approach to Eptec and its shareholders, and secured its target after a round of bilateral talks and due diligence. The deal was finalised in recent days, sources said.

Next and Silverfern are expected to back Eptec’s existing management team, who were also significant shareholders under the Alceon ownership structure, and aim to ramp up growth from organic initiatives and bolt-on M&A.

Sources said the strategy was to capture opportunities around defence spending and critical infrastructure maintenance, as well as broadening the firm’s focus to new sectors and geographies.

Eptec is a specialist engineering contractor working in asset preservation and rehabilitation. It is hired to help extend the life of valuable assets in the naval defence and marine, building and facilities, energy and resources, transport and infrastructure and water and wastewater sectors. Its services include corrosion protection, concrete rehabilitation, fibre reinforced plastics, waterproofing and linings, and insulation.

For incoming owner Next, the acquisition continues a strong run for partner James Murphy who spearheaded the transaction from the private equity firm’s side. He was also responsible for Next’s $100 million commitment to allied health roll up InterHealthcare late last year.

It also continues a deals streak for Next, which has included the sale of bowling alley owner Funlab, acquisition of a 51 per cent stake in supply chain, property and project management services business TM Insight, as Street Talk revealed last week, and its Silver Chef purchase in the second half of last year.

Next is expected to invest in Eptec via its $300 million-odd “Fund IV”. It would be the new fund’s fourth investment.

Full article access: https://www.afr.com/street-talk/next-please-buyout-fund-scoops-up-alceon-s-eptec-20200207-p53yl9

Fund IV closes a third deal with TM Insight

February 2020

Next Capital inks third deal from $300m fund IV

They say good things come in threes. And mid-market private equity firm Next Capital has done its bit to make sure that holds true, closing a third deal for its $300 million-odd fourth fund last week.

Milan Andjelkovic, left, and Travis Erridge, co-founders and directors of TM Insight.

Street Talk understands Next Capital has bought a 51 per cent stake in supply chain, property and project management services business TM Insight, as the company’s founders Travis Erridge and Milan Andjelkovic sold down their holdings.

TMI has 50 staff across four offices in Sydney, Melbourne, Brisbane and Singapore, and works with clients including BMW, Kathmandu, Woolworths, Asahi and Bunnings to streamline their supply chains.

The Next Capital deal gave TMI an implied enterprise value of about $60 million, which was five times its earnings. The founders plan to use the new equity to expand TMI’s offering into Asia, from a Singaporean launchpad.

The stake will sit in Next Capital’s fourth fund, which is on track for a final close at just above the $300 million mark in coming weeks.

The John White and Patrick Elliott-led firm has already tucked away two other deals into the new fund, acquiring a majority stake in health roll-up InterHealthcare for $100 million last December and purchasing Silver Chef’s hospitality business three months before that.

Full article access: https://www.afr.com/street-talk/next-capital-inks-third-deal-from-300m-fund-iv-20200204-p53xhn

Next Capital commits $100m to fuel allied health pioneer

December 2019

Private equity firm Next Capital is seeking a slice of Australia’s $6 billion-plus a year allied health care sector, taking a stake in ambitious new roll-up InterHealthcare.

Street Talk can reveal Next Capital has committed $100 million to help fund InterHealthcare’s acquisition-led growth strategy, and will own 50.1 per cent of the business. InterHealthcare management will retain the other 49.9 per cent.

InterHealthcare’s ambitious plan starts with the acquisition of 35 multi-disciplinary allied health practices, which will join its network this month. The incoming practices together turned over more than $30 million in the past 12 months and are based around the country.

The next step is finding new targets, with InterHealthcare aiming to be Australia’s leading multi-disciplinary allied health service provider by mid-2020.

It has Next Capital’s $100 million warchest and is actively looking for deals, with expectations of 70 clinics by the end of March.

“It’s holistic allied health and a typical Next Capital deal; a well-run business, excellent growth profile and backed by industry-leading people,” Next Capital founding partner John White told Street Talk on Sunday.

White and fellow Next Capital partner James Murphy will join InterHealthcare’s board as part of the agreement.

A national network in a fragmented industry

InterHealthcare’s goal is to create a national network of allied health businesses, operating across the various sub-sectors which are largely funded by extras cover in private health insurance policies.

Australia’s allied health industry is said to have annual revenue worth more than $6 billion and 35,000 registered businesses. Use of allied health services is said to have increased more than 40 per cent in the past decade.

“It’s an incredibly fragmented industry,” Murphy said.

“Really, our view is that no one has yet been able to build a platform that systematically aggregates the right type of practitioners in the industry.

“What we are looking for in this roll-up is what [InterHealthcare CEO] Jason McMillan has already identified.

“The right type [of acquisition] is the larger practice group which is led by four to five chiros or physios or whatever the modality may be that have 20-40 practitioners and support staff working for them; are highly regarded in the industry; and which can operate across multiple sites and deliver multiple modalities.”

An ASX-listing down the track

Murphy said it was important that McMillan and his team saw themselves running the business in 10 years’ time, and that they were setting up the business to be a long-term player in the market.

“There’s a huge array of ways that InterHealthcare can grow – organically and also by picking the eyes out of the industry,” he said. “Subject to size and markets, we think it’s absolutely a business that could be listed down the track.”

McMillan co-founded what is now InterHealthcare last year, putting together a platform that could be scaled up to thousands of clinicians and staff.

He said InterHealthcare’s pitch was to stay out of the day-to-day running of clinics but provide back-end processes such as IT, management and technology required to drive a business forward.

“I think we can help to revolutionise the allied health industry which would have a positive effect on the average Australian and really also raise the profile of allied health practitioners.”

Full article access :https://www.afr.com/street-talk/next-capital-commits-100m-to-fuel-allied-health-pioneer-20191206-p53hjm

Silverchef gets Blue Stamp nod for Next Capital hospitality sale

Silver Chef founder Allan English. Picture: Richard Waugh

September 2019

Food and hospitality finance company Silver Chef has entered into an agreement with a consortium of investors backed by private equity firm Next Capital to offload its hospitality subsidiaries for $18.25 million after securing the support of a major shareholder.

Blue Stamp Company, which own 19.99 per cent stake in Silver Chef, previously threatened to block a deal with the Next Capital-led consortium, claiming the offer undervalued the listed business.

But in an announcement to the market on Monday, Silver Chef said Blue Stamp had agreed to support the latest bid, in the absence of a superior proposal.

As part of the transaction, Silver Chef will undertake a restructure so that all of the assets and liabilities of the hospitality business, including a debt facility and warehouse securitisation facility, will be novated to the hospitality group and amended so that Silver Chef will be released from completion.

All employees of Silver Chef will transfer to the hospitality business as part of the restructure.

The funds from the sale will be used to pay down debt on its equipment financing business GoGetta, leaving the company with no material debt, Silver Chef told the ASX on Monday.

Meanwhile Silver Chef will continue with an orderly run down of the GoGetta business.

The consortium of investors will buy a number Silver Chef’s subsidiaries, including the Silver Chef Rentals businesses in Australia, New Zealand and Canada, as well as Silver Chef Foundation, Silver Chef Equipment Trust No 1 and two US subsidiaries.

The deal remains subject to approval by shareholders, who will vote on the transaction at the company’s annual general meeting on November 4.

It also relies on approval by the Foreign Investment Review Board and Silver Chef and Next Capital agreeing on the steps of the restructure and its implementation.

Article access: https://www.theaustralian.com.au/business/companies/silverchef-gets-blue-stamp-nod-for-next-capital-hospitality-sale/news-story/75cd2337fe82d0853343de46726bcddb

Next Capital finalises deal to buy NZ BUS

Next Capital founding partner John White. Picture: Simon Bullard

September 2019

Australian private equity firm Next Capital has finalised its deal to buy the NZ Bus business from Infratil in a deal that values the business at between $NZ145 million ($136m) and $NZ165m ($155m).

It comes after Infratil (IFT) launched a strategic review of the business last year.

Infratil said the final consideration reflected the challenging environment the business had operated in over the last eight months and Infratil’s midpoint estimate of the earn-out component outcome.

The acquisition is the eighth and final investment in Next Capital’s Fund III and comes as the company moves to sell its Onsite Rentals mining services business through BAML, Macquarie Capital and Moelis.

UBS advised Infratil on the NZ bus sale while Marry & Co advised Next Capital.

Article access: https://www.theaustralian.com.au/business/dataroom/infratil-offloads-nz-bus-to-next-capital-in-deal-that-values-firm-at-up-to-155m/news-story/0cbb2d14b1d1c9745ac4f4db348babca

James Murphy on development and sale of Forest Coach Lines

Australian private equity firm Next Capital sold its portfolio company Forest Coach Lines to Singapore-based transportation company ComfortDelGro Corporation [SGX: C52] earlier in August for AUD 110m (USD 81.8m).

James Murphy, partner at Next Capital, retraces the history of the PE manager’s involvement in the industry and discusses the rationale of the initial investment and how Next Capital transformed the business. Murphy’s deal profile can be found here. For an overview of Next Capital’s portfolio companies, please click here.

Next Capital’s investment in Forest Coach Lines in 2014 followed its previous success with New Zealand bus business Go Bus, which the PE owner exited in the same year after more than doubling the company’s earnings during its two-year tenure. Driven by the government’s push for more efficiency and corporatization in the transport space, Next Capital recognized that its strategy in building Go Bus could be “replicated” in Australia where the bus transport market was more fragmented than New Zealand, albeit with more robust population growth. Spot the opportunity.

Next Capital did a “market mapping” in Australia, which identified Forest as “the best potential” in the market because of its location in Sydney, its reputation as a great bus operator, as well as its future growth prospects, Murphy said Forest was one of Australia’s oldest family owned bus businesses, started by brothers Trevor and Eric Royal in 1930 in the northern suburbs of Sydney. It was managed by the family’s third generation including David Royle, the joint CEO, at the time Next Capital looked at it. Meanwhile, KPMG was mandated by the founding Royle family to run a sale process, while Sydney- based advisory firm Greenstone was working with David to buy out the whole business, Murphy noted. Next Capital then engaged with Greenstone to partner with David, who owned a small stake, and participated in the KPMG-led process, he said.

Make the deal

There were other trade buyers vying for Forest in the KPMG process, but the Royle family took the view that they would rather sell to a consortium including David so that the business could stay in family hands for longer, according to Murphy.

Next Capital also brought in Marcus Gerbich to the deal, who, as the original owner of Go Bus, had great experience of growing the New Zealand business along with the PE investor.

“David (Royle) was looking for someone with the capital and someone with experience,” Murphy said. “That is why Marcus and Next Capital’s experience with Go Bus and more broadly in growing family run businesses was critical to the (Forest) deal.”

On completion of the deal in December 2014, Next Capital bought an about 80% stake in Forest, while Gerbich came in as an executive chairman with about 5% and David Royal, the CEO, ended up with around 15%, according to Murphy.

Active management

Next Capital has been a “very active manager” in Forest, as with its other portfolio companies, said Murphy. The PE team spoke to the CEO and the chairman every couple of days and helped the company with recruitment, operation systems, banking, as well as strategic initiatives including acquisitions. It built a new management team within Forest, with every single manager that reports to the CEO (David) being a new hire, including COO, CFO, engineering manager, head of charter business, depot manager and HR manager, Murphy continued.

The company enhanced its capability in the Terry Hills depot, from which it could remotely manage businesses around Coffs Harbour in the north coast of New South Wales (NSW) and in New England in the northwest of NSW, he said. Apart from public transport, the PE manager also built up the charter business by engaging with private schools to strengthen the division.

Strategic acquisitions

Consolidation had been a complementary strategy in growing Forest, just as the PE investor did with Go Bus in New Zealand. Acquisition opportunities often came from bus companies with baby boomer owners looking to retire, Murphy said.

Backed by the PE owner, Forest made four acquisitions in NSW including Manly Coaches, a charter business in Sydney’s lower north shore, and three regional businesses: Wolters Bus and Coach Service, Sawtell Coaches, and Ryans Bus Service. The PE partner would not specify the acquisition values.

For Forest, the four acquisitions are strategic assets that bring in long-term contracts, he noted. Forest was also able to implement its own operation system in those businesses and therefore reduce cost and drive efficiency, he added.

Local market

Australia’s bus transport market is still highly fragmented, with the top 10 operators having about one third of the market and a long tail of approximately 1,000 operators, Murphy explained. It is hard to quantify the exact size of the market as there are different components including scheduled, charter, tourist coach, etc., he said. There is no obvious competitor to Forest in NSW, he noted. New government contracts were awarded about 18 months ago in rural and regional NSW, while in Victoria and Queensland new contracts are currently being finalized, Murphy said. This could drive a new wave of consolidation in the market, he said.

Exit to “logical buyer”

Next Capital has always known that a number of trade buyers would be interested in Forest, including Singapore’s ComfortDelgro [SGX: C52] that operates across Australia and has made a couple of acquisitions over the past few years, according to Murphy. The PE owner appointed Melbourne-based Heritage Finance earlier this year, which engaged with a limited number of strategic buyers. “It’s fair to say ComfortDelgro was the most interested,” said Murphy, declining to comment on other parties.

The process took a couple of months and ran smoothly as the due diligence was relatively simple, he said. ComfortDelgro knew the asset, the area, as well as the contracts and appreciated the strategic positioning of Forest, according to Murphy.

Financials

Forest went from AUD 6m in EBITDA when Next Capital invested to more than AUD 15m earnings at the exit, according to Murphy.

ComfortDelgro is acquiring the business for AUD 110m, according to a stock exchange announcement on 7 August.

Advisors

Next Capital used Heritage Finance (led by Candice Hendra) as financial advisor and MinterEllison (led by Glen Sauer) for legal service. PwC advised tax issues and did the financial due diligence.

ComfortDelgro used its internal team for M&A and Lander & Rogers for legal service. The fund

The exit of Forest was the second out of Next Capital’s AUD 285m Fund III, Murphy said.

Next Capital has raised three funds so far, all under AUD 300m, according to Mergermarket data. It is understood that 80% of the Fund III has been deployed now.

Murphy on Profiler

Murphy, a former banker with UBS, has been with Next Capital since 2007 and became the partner in 2014.

He has been involved in Next Capital’s investments in Scottish Pacific, Infinite Care, Forest Coach Lines and Lynch’s flowers.

Next Capital Snaps Up iseek Communications In Data Centre Play

September 2018

Mid-tier private equity firm Next Capital has made a bet on Brisbane-based iseek Communications in a deal valuing the data storage and cloud services provider at $60 million including debt.

iseek is an Australian-owned, independent data storage provider focused on data storage, cloud and connectivity services.

The company operates two data centres in Brisbane and one in Sydney. It has annual revenue of about $34 million, and has been profitable for a number of years. It is hoping to triple its earnings over the next three years, underpinned by two new data centres being built.

iseek currently is building a data centre in far north Queensland, which will open in the first quarter next year, while a third data centre in Brisbane is slated to open by 2020. The Sydney-based buyout firm has purchased a controlling stake of 51 per cent, however, it is acting in partnership with founder Jason Gomersall, who started the business 20 years ago and was previously 100 per cent owner.

The data centre business is its biggest earner and has customers including Queensland state government or government-owned organisations, as well as Top 200 listed companies.

Mr Gomersall explained the data centres host the technology infrastructure for cloud service providers, network providers and enterprise clients, but is not responsible for cyber security or network security.

Next’s investment comes amid heightened interest in the sector, with listed data centre operator NextDC on Friday flagging it will invest $2.25 billion in its three new sites in Melbourne, Sydney and Perth. Other transactions in recent months include the $1 billion sale of Metronode to US data centre giant Equinix. In 2016, Quadrant Private Equity and Infratil, which is managed by Morrison & Co, cut an $800 million deal for Canberra Data Centres.

Next partner James Murphy said recent deals show the strength of the segment.

“Thematically a lot is happening in this space,” he said. “People are trying to find capacity, and you have got the big players like the Amazons and Apples looking to provide their cloud offering.”

Next is building the iseek business with the view of a public float down the track. “The thematic is well received by equity markets, it has high returns on capital and sticky long-term cashflow,” Mr Murphy said.

iseek has pursued a leasehold model for its two greenfield sites, where a landlord develops the building and iseek will fit it out at a cost of between $10 million to $20 million. Mr Murphy confirmed it has long-term leases with security over the sites.

Next’s founding partner Patrick Elliott said there is plenty of growth in the sector with only 30 per cent of businesses outsourcing data centre management.

“We did a lot of work around the sector and demand for storage across the spectrum from data centres to cloud is exploding,” he said. “On the supply side there is limited representatives that can deliver on the level of service that Jason has provided.”

Mr Gomersall, who prior to starting iseek owned two OPTUS mobile franchisee shops, said iseek has a great track record in terms of building and operating these facilities.

Mr Gomersall added that the business is defensive, and not bothered by the recent political circus that took over Canberra. “Demand for the sector seems to be there separately from what’s happening politically, thankfully we are fairly immune as to what’s happening at that level,” he said. “During the GFC we didn’t see any of our customers including miners and mining services did not cut business, while cutting other services in their business. We are essential services.”

In the beginning, iseek was an ISP to the corporate sector. At that time there were no commercial data centres. Some corporate customers took space with him, and in that process Mr Gomersall built iseek’s first data centre.

Given its leading position in Queensland, Mr Gomersall engaged PwC Advisory to find him a partner for his next leg of growth.

The investment will be made via the Next Capital III fund, which has deployed about 75 per cent of its capital, with one or two more investments to come. iseek is the second investment in 2018 following artisan bakery Noisette.

Fundraising for its Fund IV is kicking into high gear, and sources said it is likely to have a first close by November or December. Its Fund III should be a “cracking fund”, so Fund IV should get raised relatively easily, and will be around the $350 million mark, sources said.

Next founding partner Sandy Lockhart is likely to still be involved as chairman, but not as a day-to-day deal partner.

Full article access here: https://www.afr.com/markets/market-data/next-capital-snaps-up-iseek-communications-in-data-centre-play-20180831-h14rza?btis

Acquisition of Noisette Bakery

In January 2018 Next Capital completed the acquisition of Noisette Bakery (“Noisette”), a Melbourne based artisanal commercial bakery.

Noisette is Victoria’s largest wholesale artisanal baker, supplying 1,350 customers throughout Melbourne and regional Victoria. The Business sells a range of cakes and pastries (predominantly croissants) to a diversified range of customers while also operating two retail sites in port Melbourne and Bentleigh. Noisette has a unique baking and production process, balancing manual handmade steps and automated processes, allowing it to provide a quality artisanal product across 250 SKUs. The wholesale business operates one of the largest baked fresh daily operations in Australia, running 24/7 from a 2,800 sqm production facility in Dandenong, Victoria. The customer base is highly diversified with customers include cafés, restaurants, hotels, food service and independent supermarkets.

Link to Press Article:

“Next Capital closes in on fancy bread maker”. Australian Financial Review 16 Nov 2017

http://www.afr.com/street-talk/fancy-bread-maker-up-for-sale-kpmg-hired-20171114-gzlm10

Onsite Rental acquires GCS Hire

Infinite

Tuesday 19 September 2017

Moelis Australia Acquires Controlling Interest in Infinite Care

Scale Investment in Australian Aged Care Sector

Sydney, 19 September 2017 – Moelis Australia Limited (“Moelis Australia”) (ASX: MOE) has entered into an agreement with Next Capital to acquire a controlling interest in Infinite Care, an operator and developer of aged care facilities in Australia. The acquisition involves Moelis Australia paying $45.4 million for a 70% interest in Infinite Care in addition to the establishment of the Moelis Australia Healthcare REIT. Infinite Care’s founding management will retain its 30% stake in Infinite Care.

Infinite Care is an industry leader in the delivery of responsive, holistic and innovative care and services to the ageing community. Infinite Care currently operates a portfolio of 5 recently refurbished aged care facilities and has a development pipeline of ~1,500 bed licenses across 13 to be developed facilities in areas of aged care undersupply.

Moelis Australia will hold its interest in Infinite Care in a newly established managed fund, the Moelis Australia Aged Care Fund (“Infinite Fund”). Moelis Australia intends to offer third party investors the opportunity to co-invest in the Infinite Fund with Moelis Australia retaining a co-investment stake of not less than 10%. Founders and Joint Managing Directors of Infinite Care, Chris Stride and Tony Partridge will continue to run the business.

The Infinite Fund is targeting a total return to third-party co-investors of 20%+ per annum over a 4 year term. The Infinite Fund will provide investors with exposure to the attractive fundamentals of the Australian aged care sector via co-investment in an established operator with a large development pipeline. Profitable and cash flow generative, Infinite Care has an existing ~400 bed platform, an established head office function and a substantial greenfield development pipeline of ~1,500 bed licenses across 13 to be developed facilities in areas of aged care undersupply. Importantly, Infinite Care has a highly experienced and financially aligned management team, with a strong track record in aged care.

Fully developed, Infinite Care’s 1,500 bed pipeline of new aged care facilities should have a total value in excess of $450 million.

As a component of the transaction the Moelis Australia Healthcare REIT (“REIT”) will acquire the freehold real estate and provide development funding for two of Infinite Care’s new aged care facility developments. The initial investment of $44.5 million in equity to acquire and fund these assets will be fully subscribed by funds managed by Moelis Australia. The REIT is forecast to deliver investors a distribution yield of approximately 7% per annum and total return of 10% per annum. Moelis Australia will manage the REIT. The REIT has potential to grow over time as new facilities are acquired and/or developed.

Andrew Pridham, Chief Executive Officer of Moelis Australia said “We are excited by the opportunity to invest in the Australian aged care sector and offer our investors exposure to an industry which we believe has very favourable fundamentals, driven by Australia’s rapidly aging population and looming undersupply of aged care facilities.

We believe Infinite Care is a quality business with significant potential for growth. It is led by a highly experienced and aligned management team and we look forward to supporting Chris and Tony over the coming years as they grow the business.

This investment in the Australian aged care sector is consistent with our strategy of investing in what we believe are attractive industry segments characterised by sound macro fundamentals, underlying real estate exposure and quality management teams.

This transaction highlights our ability to originate attractive high return opportunities for clients of our asset management business and Moelis Australia, and we look forward to growing our activities in the aged care sector over time.”

The transaction is conditional on FIRB approval and standard closing conditions and is expected to complete in late October 2017.

Scottish Pacific

Scottish Pacific:

Next Capital successfully completed an exit of half of its stake in Scottish Pacific through an IPO on the ASX in July 2016. The business was floated for a Market Value of nearly $450M, realising an upfront return of approximately 2x for its investors and management, with the potential for material additional returns through monetisation of Next Capital’s remaining 50% stake. The business is well placed to continue its strong growth given:

- ScotPac’s leading market position in a niche segment with significant barriers to entry;

- low-risk growth potential associated with the business’ ability to leverage strong underlying long-term demand in the core debtor finance market;

- significant incremental growth potential associated with new products and channels in development; and

- a very strong, experienced and incentivised management team, with a history of delivering strong year-on-year growth through economic and credit cycles.

Alpha Group

Alpha Group:

Next Capital successfully completes the majority acquisition of Alpha Group (“Alpha”).

Next Capital completed the acquisition of a controlling interest in Alpha in April 2017. Established in 2006 as a car hire business, today Alpha Group is a provider of car leases, whilst also operating synergistic car hire and car parking businesses.

Next Capital’s investment has been predicated on the following factors:

- leading market position in a niche segment with significant barriers to entry and a strong value proposition;

- attractive platform asset with three synergistic divisions providing a basis to generate enhanced returns to the Group;

- significant growth prospects, with actionable opportunities to increase penetration in existing markets as well as further geographic expansion, utilising new sales channels, servicing other markets as well as scale benefits delivering cost synergies; and

- highly experienced and proven management team.

Funlab

Funlab:

Next Capital successfully completed the acquisition of a controlling interest in Funlab in December 2016. Funlab creates, develops and operates out-of-home entertainment and leisure venues. The Business currently services over three million customers per annum, across three concepts from 17+ locations on Australia’s eastern seaboard:

- Strike Bowling bars: social bowling, escape rooms, laser tag, karaoke, pool and a licenced bar and kitchen;

- Sky Zone indoor trampoline parks are operated under a franchise agreement with US franchisor; and

- Holey Moley: Australia’s first putt putt mini-golf with full service licenced bar

The out of-home leisure and entertainment industry is benefitting from a global trend, where consumers are spending more of their disposable income on experiences and less on goods. Funlab delivers a superior offering relative to its competitors in both the bowling bar and trampoline park markets. The business’ newest offering, Holey Moley, is a new concept in Australia with no competitors to date.

Lynch Holdings

Lynch Group Holdings:

Next Capital successfully completes the majority acquisition of Lynch Group Holdings (“Lynch”).

Next Capital completed the acquisition of a controlling interest in Lynch in November 2015. Lynch is Australia’s leading integrated supplier, wholesaler and merchandiser of fresh cut flowers and potted plants. Lynch also operates flower farming and processing assets in Kunming, China as well as three farms in Australia which grow and supply specialty flower and potted products to support its range.

Lynch is Australia’s only fully integrated floral and potted plant operator. Its operations span and control all aspects of the fresh flower and potted plant value chain, which positions Lynch as the clear industry leader with strong market share in all the key markets in which it competes. Lynch is vertically integrated across sourcing (third party and internal), design and processing, distribution / merchandising and sales The core business, which services the mass market retail channel, has a leading market position which provides a strong core growth proposition and the opportunity to execute a range of domestic and international growth initiatives.

IPO of Vitaco Holdings

Next Capital successfully completed the majority exit of its investment in Vitaco through an IPO on the ASX in September 2015. The business was floated for an Enterprise Value of $332M generating a return of 3.2x for its investors and management. The business is well placed to continue its strong growth given:

- Leading market positions with established and trusted brands like Healtheries, Nutra-Life, Aussie Bodies and Musashi

- Exposure to attractive categories with multiple avenues for growth including continued new product development, expansion of distribution points, margin expansion through the in-sourcing of products and exposure to high growth regions like China

- Diversified product portfolio with multiple channels to market

- Operates a vertically integrated business model that develops, manufactures, distributes and markets its products, with capacity to support future growth

- Highly experienced management team

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/TSPIPUSZBFLNJLIDB27FCY7EHY.jpg)

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/KWEAYNP72XUGJOW3EIMCYOYB7E.jpg)